SBA 1031 2017-2026 free printable template

Show details

720 b 1 If the answer to number 31 is Yes you must complete Part D. 32. Financing Comments SBA Form 1031 11/2017 Previous Editions Obsolete Part D Passive Business Financing Information Only provide Part D if the financing was structured using at least one passive business. 552 which allow SBA to exempt from disclosure financial data on individual companies. Instructions for Submitting Completed Form SBA Form 1031 must be completed and filed electronically in the SBIC-Web system. SBIC-Web...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sba 1031 form

Edit your financing report template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financing report business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2017 financing report form business template online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit financing report business pdf form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SBA 1031 Form Versions

Version

Form Popularity

Fillable & printabley

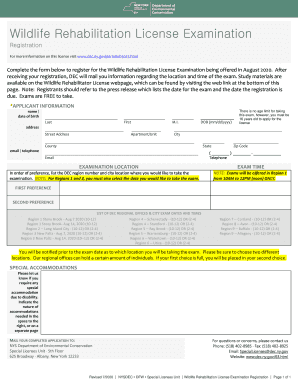

How to fill out financing report business template form

How to fill out SBA 1031

01

Obtain the SBA 1031 form from the official SBA website or your local SBA office.

02

Read the instructions carefully to understand the requirements and eligibility.

03

Fill out your business information in the designated fields, including name, address, and contact details.

04

Provide details of your loan request, including the amount, purpose, and proposed use of funds.

05

Attach any required documentation, such as personal and business financial statements, tax returns, and business plans.

06

Review the completed form for accuracy and completeness.

07

Submit the form along with any required attachments to the appropriate SBA office or lender.

Who needs SBA 1031?

01

Small business owners seeking to acquire real estate or certain types of property.

02

Entrepreneurs looking to refinance existing debt to take advantage of better loan terms.

03

Businesses in need of working capital for expansion, equipment purchases, or renovations.

Fill

financing report download

: Try Risk Free

People Also Ask about financing report make

What is the business income form?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

How do you show income when you own your own business?

Some ways to prove self-employment income include: Annual Tax Return (Form 1040) This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

How do I report income from my own business?

There is no W-2 self-employed specific form that you can create. Instead, you must report your self-employment income on Schedule C (Form 1040) to report income or (loss) from any business you operated or profession you practiced as a sole proprietor in which you engaged for profit.

What is business income for tax purposes?

Business income is earned income and encompasses any income realized from an entity's operations. For tax purposes, business income is treated as ordinary income. Business expenses and losses often offset business income.

Is a Schedule C the same as a 1099?

A 1099 is not the same as Schedule C. A 1099 typically reports money exchanged between a payor and a payee. A copy of a 1099 usually goes to both the payee and the IRS. Depending on the type of income earned or 1099 received, you may report this on Schedule C or other Schedules of Form 1040.

What is an example of income in business?

Dividends are an example of income paid by a company that you own or are part-owner of. Dividends are a share of the profits created through company operations. With dividends, shareholders receive money from a pool of profits made by the company. Dividends are only available if the company has made a profit.

What makes something considered a business?

A trade or business is generally an activity carried on for a livelihood or in good faith to make a profit. The facts and circumstances of each case determine whether an activity is a trade or business.

How do you get business income?

Calculate your total revenue. Subtract your business's expenses and operating costs from your total revenue. This calculates your business's earnings before tax. Deduct taxes from this amount to find you business's net income.

Does your business count as income?

For a sole proprietorship, your business income is reported directly on your personal federal income tax return, which means your business doesn't owe taxes separately. Instead, you'll pay taxes on your business's earnings at your individual federal income tax rate.

Is all business income taxable?

In general, any revenue is taxable unless IRS rules specifically exclude it. Your gross revenue includes all income received from sales, after you subtract things like returns and discounts.

How do I report income from my business?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit. You are involved in the activity with continuity and regularity.

What is business income for self-employed?

How the IRS Defines Self-Employment Income. Self-employment income is earned from executing a "trade or business" as a sole proprietor, an independent contractor, or some form of partnership. Freelancers and "gig workers" are also considered by the IRS to be self-employed.

How much can a business make before reporting to IRS?

You have to file an income tax return if your net earnings from self-employment were $400 or more.

How to calculate the income of a business?

Calculate your total revenue. Subtract your business's expenses and operating costs from your total revenue. This calculates your business's earnings before tax. Deduct taxes from this amount to find you business's net income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my SBA 1031 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign SBA 1031 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I modify SBA 1031 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including SBA 1031, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I edit SBA 1031 on an Android device?

You can make any changes to PDF files, such as SBA 1031, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is SBA 1031?

SBA 1031 refers to a provision in the Internal Revenue Code that allows for the deferral of capital gains taxes on the exchange of like-kind properties, primarily used in real estate transactions.

Who is required to file SBA 1031?

Taxpayers who engage in a like-kind exchange of real property and wish to defer capital gains taxes must file SBA 1031.

How to fill out SBA 1031?

To fill out SBA 1031, taxpayers must complete IRS Form 8824, detailing the properties exchanged, the dates of the exchange, and the identification of replacement properties.

What is the purpose of SBA 1031?

The purpose of SBA 1031 is to encourage reinvestment in real estate by allowing individuals and businesses to defer paying capital gains taxes when they sell one property and purchase another like-kind property.

What information must be reported on SBA 1031?

Information that must be reported on SBA 1031 includes details about the relinquished and replacement properties, dates of transfer, adjusted basis, fair market value, and any liabilities assumed.

Fill out your SBA 1031 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SBA 1031 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.